February 10, 2026. 12:55 PMResources

AML Compliance for Real Estate Companies in UAE: 2026 Risk Landscape

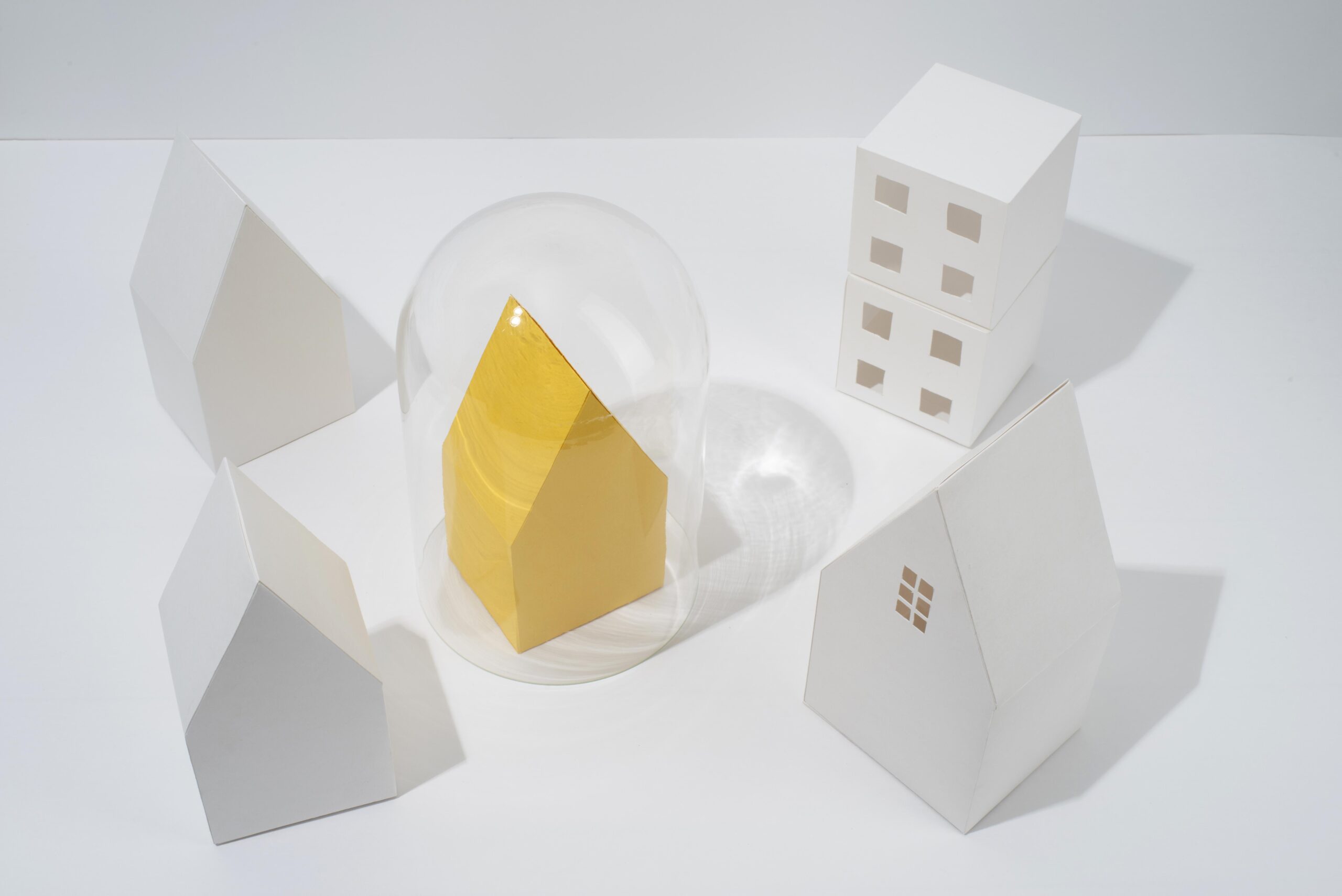

Introduction The UAE’s real estate market continues to attract global investors, high-value transactions, and cross-border capital flows. While this growth strengthens the economy, it also increases exposure to money laundering and illicit financial activity. As regulators tighten enforcement and adopt stricter monitoring measures heading into 2026, AML compliance for real estate companies has become more

February 10, 2026. 12:32 PMResources

AML Compliance in UAE: What Changes in 2026 and How Businesses Must Prepare

Introduction The UAE continues to strengthen its Anti-Money Laundering (AML) and Counter Financing of Terrorism (CFT) framework to align with international best practices and FATF standards. As regulatory oversight intensifies, 2026 is expected to bring tighter supervision, enhanced reporting requirements, and increased accountability for businesses operating across regulated sectors. For financial institutions and Designated Non-Financial

February 2, 2026. 12:16 PMResources

Streamlining AML Compliance: Tailored Services for Every Industry

Introduction Anti-Money Laundering (AML) regulations are no longer exclusive to the financial sector. In the UAE, regulators now require a wide range of industries—including real estate, precious metals and stones, corporate service providers, and legal/accounting firms—to establish strong AML compliance frameworks. To navigate this evolving landscape, businesses must adopt tailored AML compliance services that suit

February 2, 2026. 12:04 PMResources

The Importance of AML Compliance Services in the Fight Against Financial Crimes

Introduction In an era marked by increasing global financial scrutiny and heightened regulatory expectations, the UAE has established itself as a regional leader in the fight against money laundering. As a financial and trade hub connecting East and West, the nation’s exposure to illicit financial flows is significant. To counter these risks, the UAE mandates

January 13, 2026. 11:08 AMResources

AML Compliance Services in UAE: What to Look for When Selecting a Provider

Introduction As the UAE intensifies its fight against financial crimes and money laundering, compliance is no longer optional—it’s an operational and legal necessity. The UAE Ministry of Economy (MOE), in line with Federal Decree Law No. (20) of 2018 and Cabinet Decision No. (10) of 2019, has made it mandatory for DNFBPs (Designated Non-Financial Businesses

January 13, 2026. 10:55 AMResources

How AML Software Helps UAE Firms Stay Ahead of Regulatory Risk

In today’s compliance-driven environment, companies across the UAE face increasing pressure to meet stringent Anti-Money Laundering (AML) requirements. Whether you’re in real estate, precious metals and stones, or corporate services, staying ahead of regulatory expectations is not just a matter of compliance—it’s a matter of business survival. This is where AML compliance software in the

December 8, 2025. 3:31 PMResources

Why AML Compliance Software Is Crucial for the UAE’s Real Estate Sector

Introduction The UAE’s real estate sector is renowned for its rapid growth, global investor appeal, and high-value transactions. However, these very strengths make it a prime target for money laundering activities. In response, the UAE government has enforced stringent Anti-Money Laundering and Combating the Financing of Terrorism (AML/CFT) regulations. For real estate firms—classified as Designated

December 8, 2025. 2:31 PMResources

The Role of AML Compliance in Safeguarding Against Money Laundering Risks

Introduction Money laundering continues to pose a significant threat to the global financial system, and the UAE is no exception. With its vibrant economy, strategic geographic location, and diverse business sectors, the UAE is a prime target for illicit financial activity. To combat this, the government has implemented a robust Anti-Money Laundering and Counter Financing

November 21, 2025. 12:28 PMResources

Streamlining AML Compliance: Tailored Services for Every Industry

Anti-Money Laundering (AML) regulations are becoming more stringent across the globe, and the UAE is no exception. Businesses operating in high-risk sectors such as real estate, precious metals, company formation, and financial services are under increasing pressure to maintain full AML compliance. The solution? Tailored AML compliance services in Dubai and advanced AML compliance software

November 21, 2025. 12:06 PMResources

The Importance of AML Compliance Services in the Fight Against Financial Crimes

As financial crime tactics grow more sophisticated, so too must the measures businesses take to detect and prevent them. In the United Arab Emirates (UAE), particularly in high-risk sectors like real estate, precious metals, and virtual assets, anti-money laundering (AML) compliance is no longer a regulatory checkbox—it is a strategic imperative. Leveraging professional AML compliance