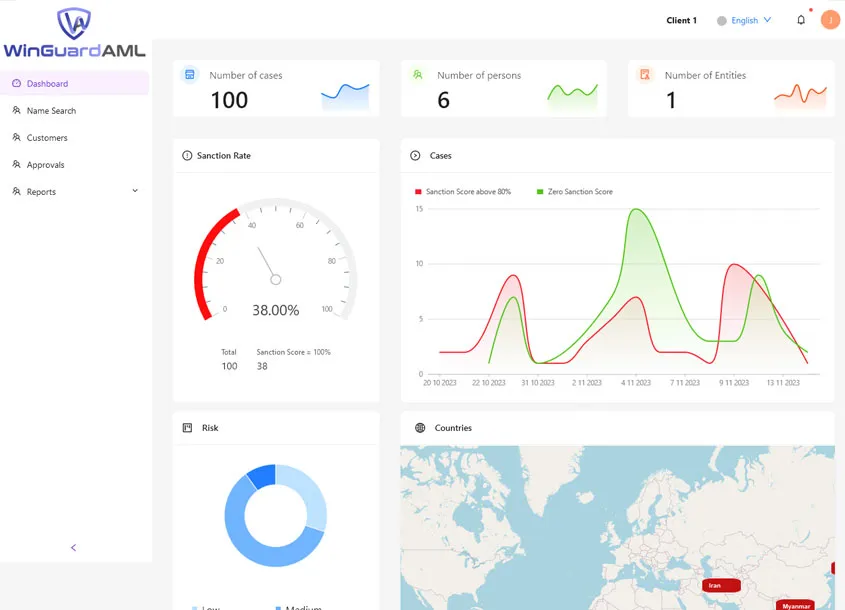

WingaurdAML - Anti Money Laundering UAE

By addressing the challenges of fraud, verification, and the digital divide, we are working towards a future where individuals and businesses can harness the full potential of the digital age without barriers.

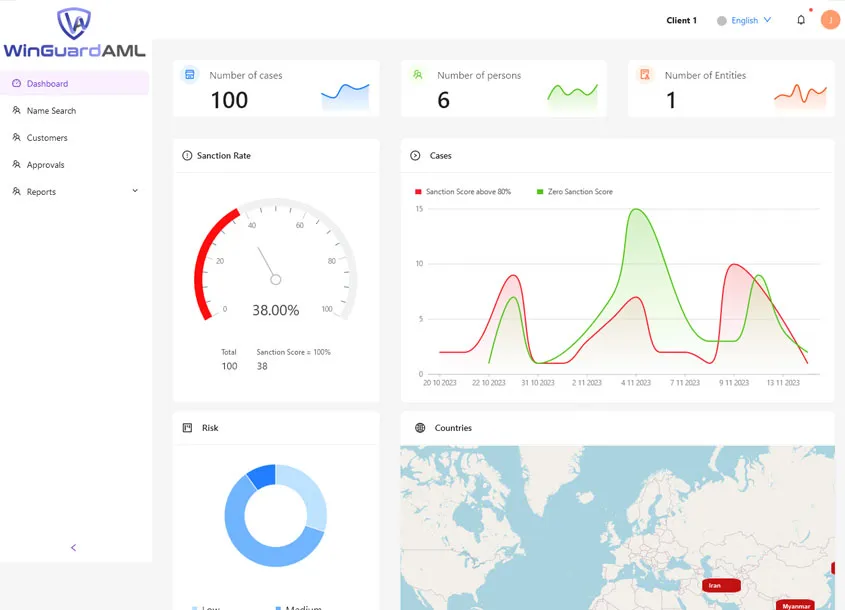

AML Compliance Services Dubai

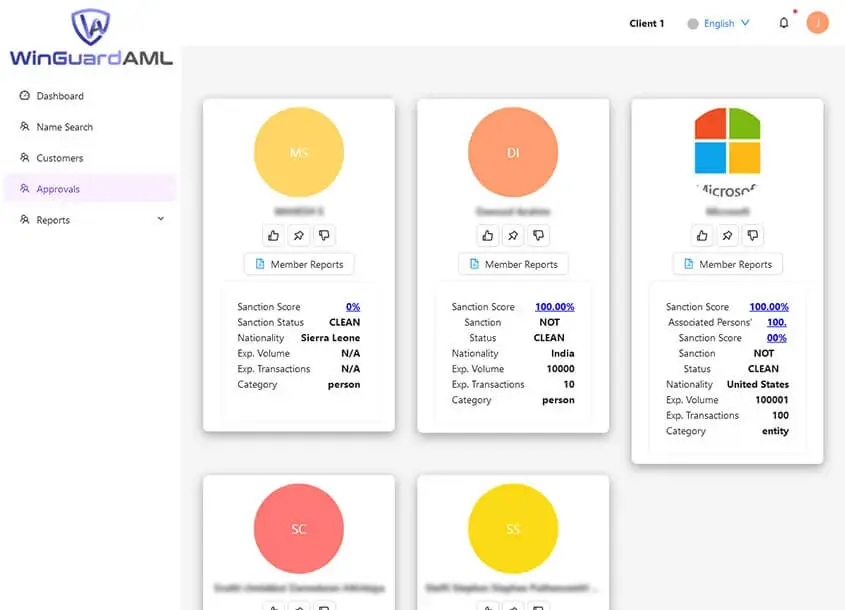

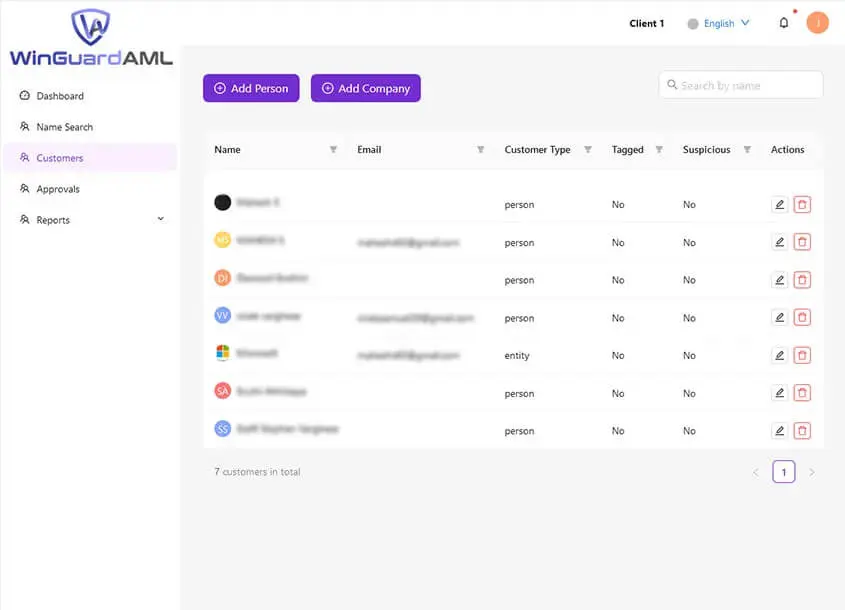

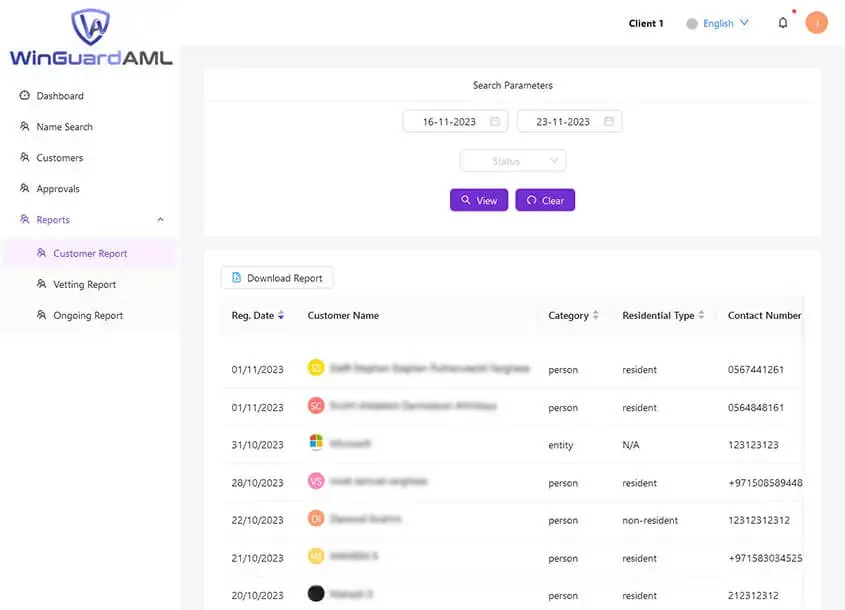

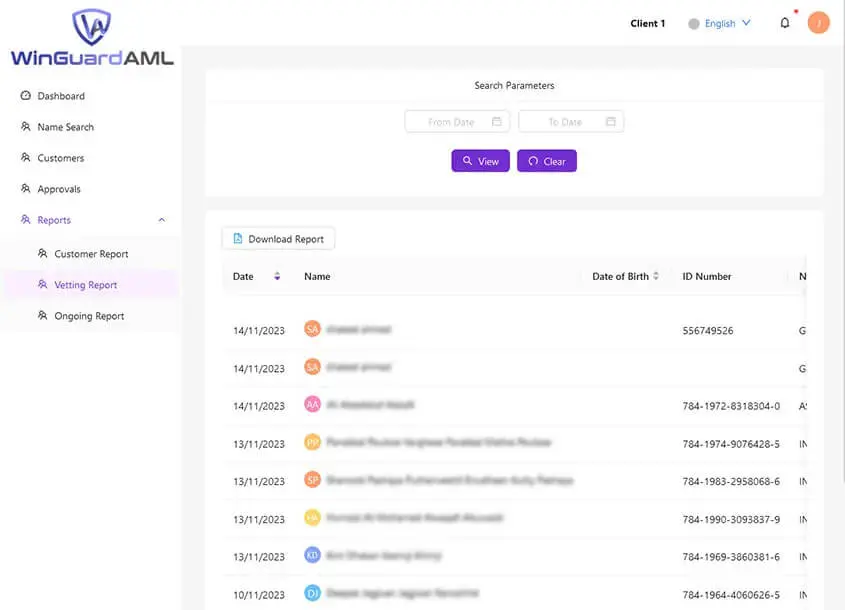

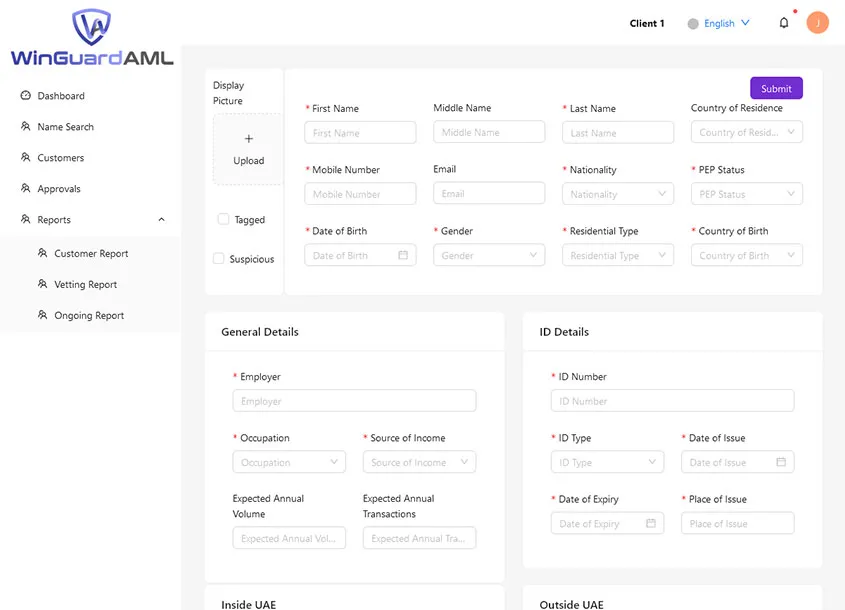

Customer Screening and Verification

With WinguardAML you can do proper customer due diligence that includes identity verification as well as comprehensive background checks in real time during the onboarding process.

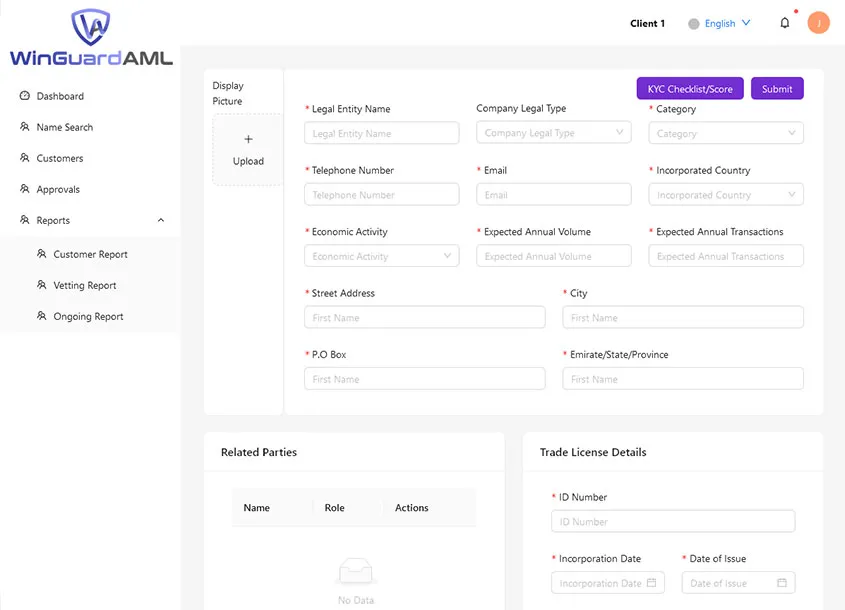

Business Screening and Verification

Proper business due diligence goes beyond checking a company name - it requires in-depth screening and verification at multiple levels – which can be done with ease with WinguardAML.

Lets create a safe business environment with WinguardAML!

What our customers have to say

Thomas Smith

Stella Smith

“They help us in so many ways that I feel like we can truly call them a partner because they have become an extension of our team.”

Ernest Smith

Eloise Smith

“They help us in so many ways that I feel like we can truly call them a partner because they have become an extension of our team.”

Thomas Smith

“They help us in so many ways that I feel like we can truly call them a partner because they have become an extension of our team.”

Stella Smith

“They help us in so many ways that I feel like we can truly call them a partner because they have become an extension of our team.”

Ernest Smith

“They help us in so many ways that I feel like we can truly call them a partner because they have become an extension of our team.”

Eloise Smith

“They help us in so many ways that I feel like we can truly call them a partner because they have become an extension of our team.”

Thomas Smith

“They help us in so many ways that I feel like we can truly call them a partner because they have become an extension of our team.”

Resources

AML Compliance Services in UAE: What to Look for When Selecting a Provider

How AML Software Helps UAE Firms Stay Ahead of Regulatory Risk

“They help us in so many ways that I feel like we can truly call them a partner because they have become an extension of our team.”